Asset management system

- Asset management system

- Securities trustee system

- Asset-liability system

- Performance analysis system

- Major references

- Contact

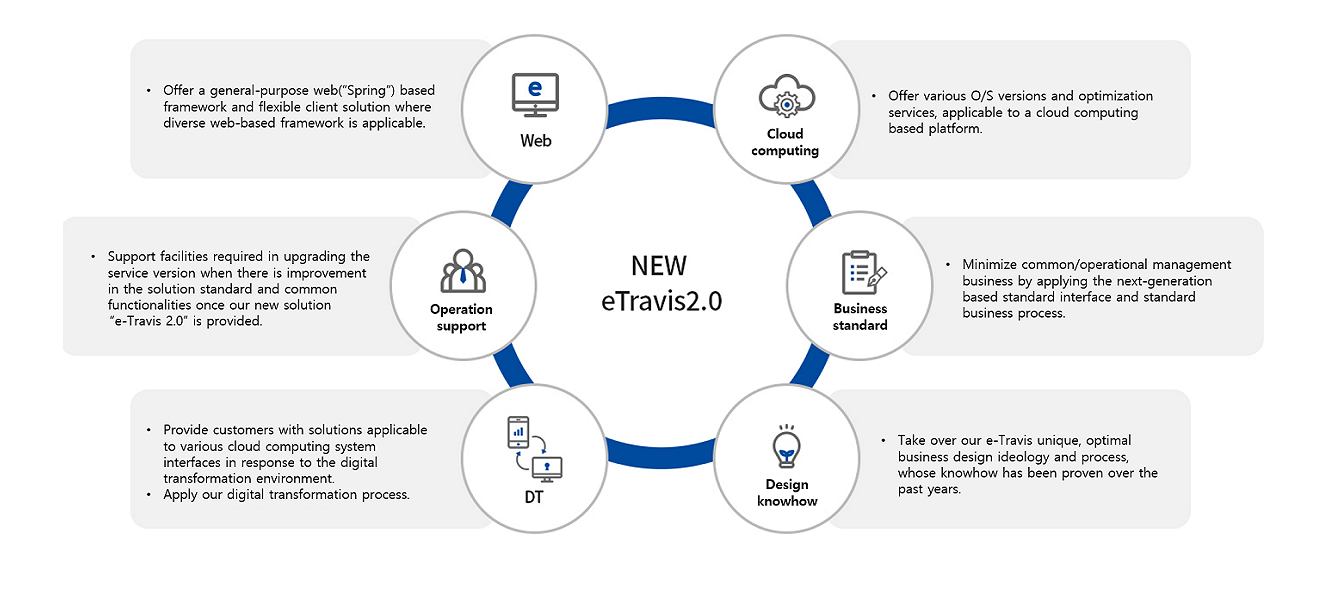

Asset management system(eTravis2.0)

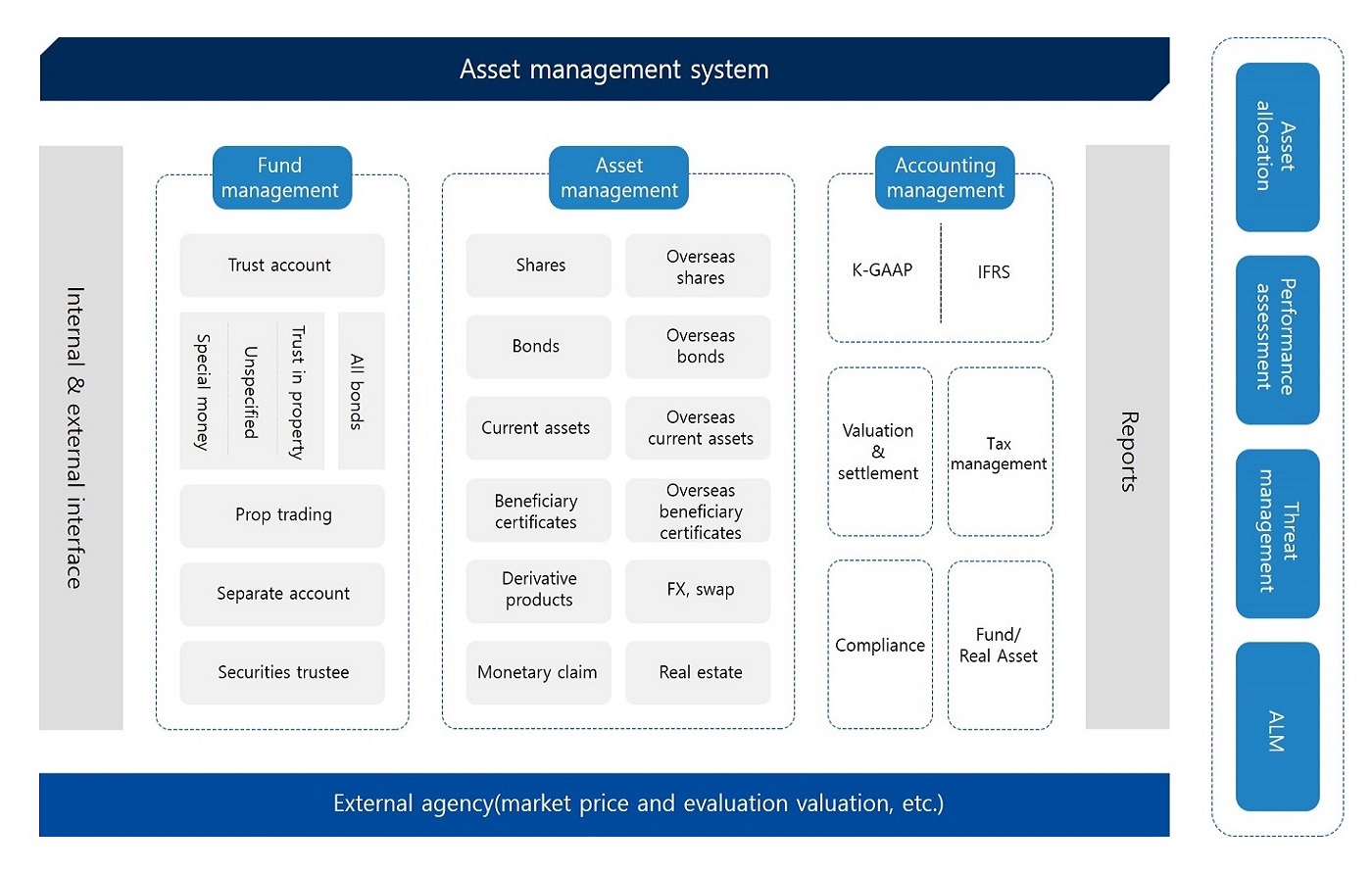

Domestic and overseas securities related products are operated and managed by financial institutions(banks, securities firms, and insurance firms) and the related institutions. (IFRS is applied.)

Accounting accounts: Prop trading, trust account, separate account, retirement pension

Operating assets: Shares, bonds, beneficiary certificates, derivative products, monetary claim, securities, real estate, intangible property, wrap asset

Trust products: Money trust(special, unspecified), trust in property(monetary claim, real estate, securities, intangible property, etc.), wrap asset trust

Main advancements

Provide and apply the standards applicable to a general-purpose framework and cloud-computing platform.

Save man days and cost by applying the standard interface and business process.

Enjoy easy maintenance thanks to a flexible product, platform, and business environment.

Diagram

Major functions

Operate and manage assets including domestic and overseas shares, bonds, current assets, and overhead assets.

Manage the settlement of accounts including the closing of the books and settlement.

Manage the operating support including funds and commodity management.

Serve as compliance including the laws and supervisory regulations.

Effects

Secure stability by seamlessly supporting the operation of domestic and overseas financial products, derivative products, and alternative assets.

Ensure transparency and reliability thanks to a real-time online function processing from product trading to accounting management.

Work efficiency and flexibility increase as a reporting system is established and the IFRS accounting standard is provided.

Strengths and uniqueness

Operate and handle all domestic and overseas financial products.

"Spring" (universal app) based framework and web-based integrated client solution are available.

The optimal design ideology and knowhow that only our eTravis possesses are applied in the system.

- Asset management system

- Securities trustee system

- Asset-liability system

- Performance analysis system

- Major references

- Contact

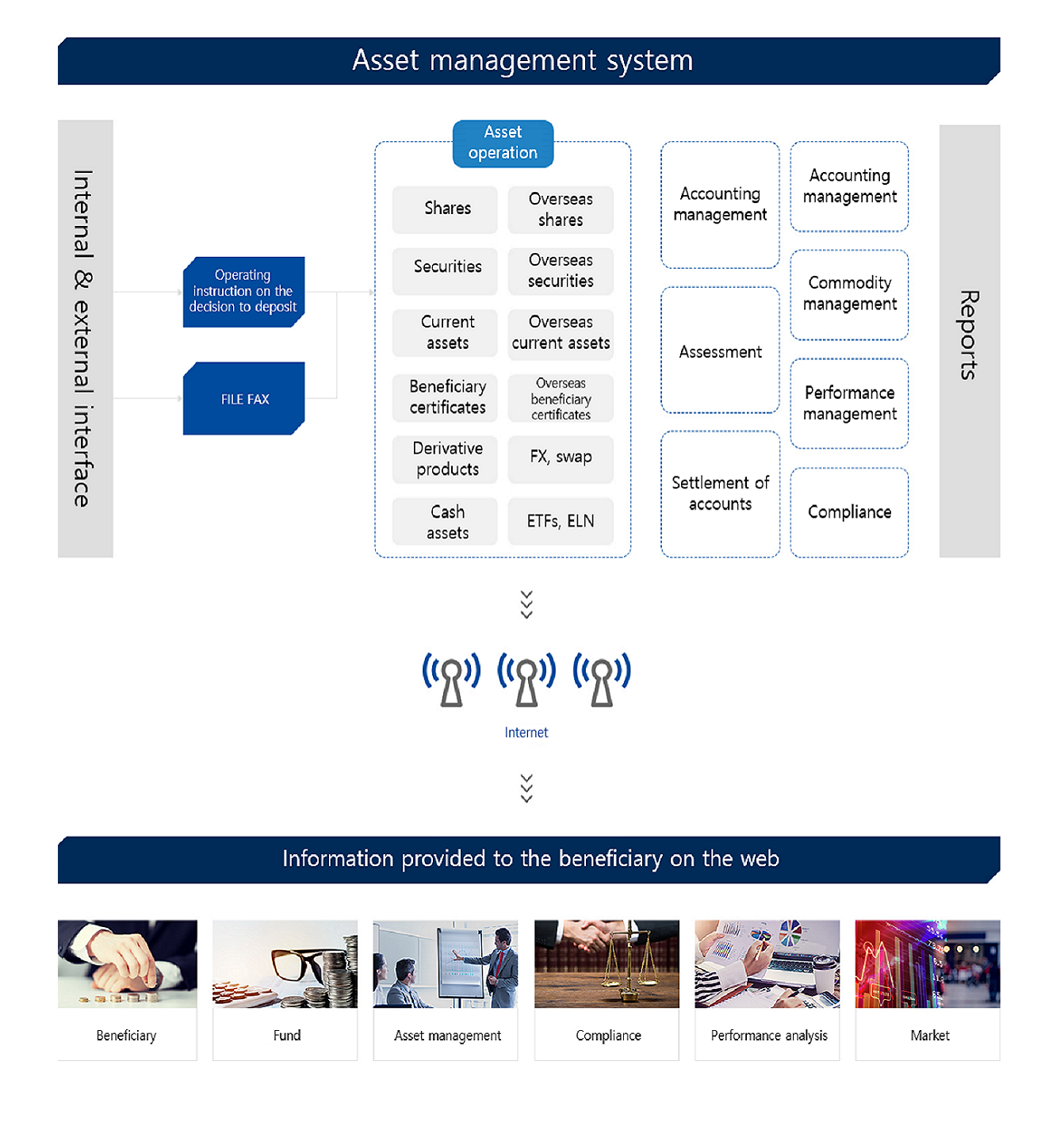

Securities trustee system

Entrust investment and trust property from a trust company to maintain investment securities, enact settlement on the price of the securities purchase and sale, receive the principal and interest/dividend, and handle the stock rights processing business.

Diagram

Major functions

Maintain investment securities.

Enact settlement on the price of the securities purchase and sales.

Receive the principal and interest/dividend.

Handle the stock rights processing business including paid-in capital increase/ increase of capital stock without consideration, subscription for shares, and merger/capital reduction.

Deal with the compliance business, etc.

Effects

Work efficiency is enhanced with automated operational instructions.

Actively respond to the supervisory regulation and systems by calculating the standard cost and handling a range of compliances.

Increased work efficiency and stable earnings foundation are ensured via a quick response to changes in the financial environment.

- Asset management system

- Securities trustee system

- Asset-liability system

- Performance analysis system

- Major references

- Contact

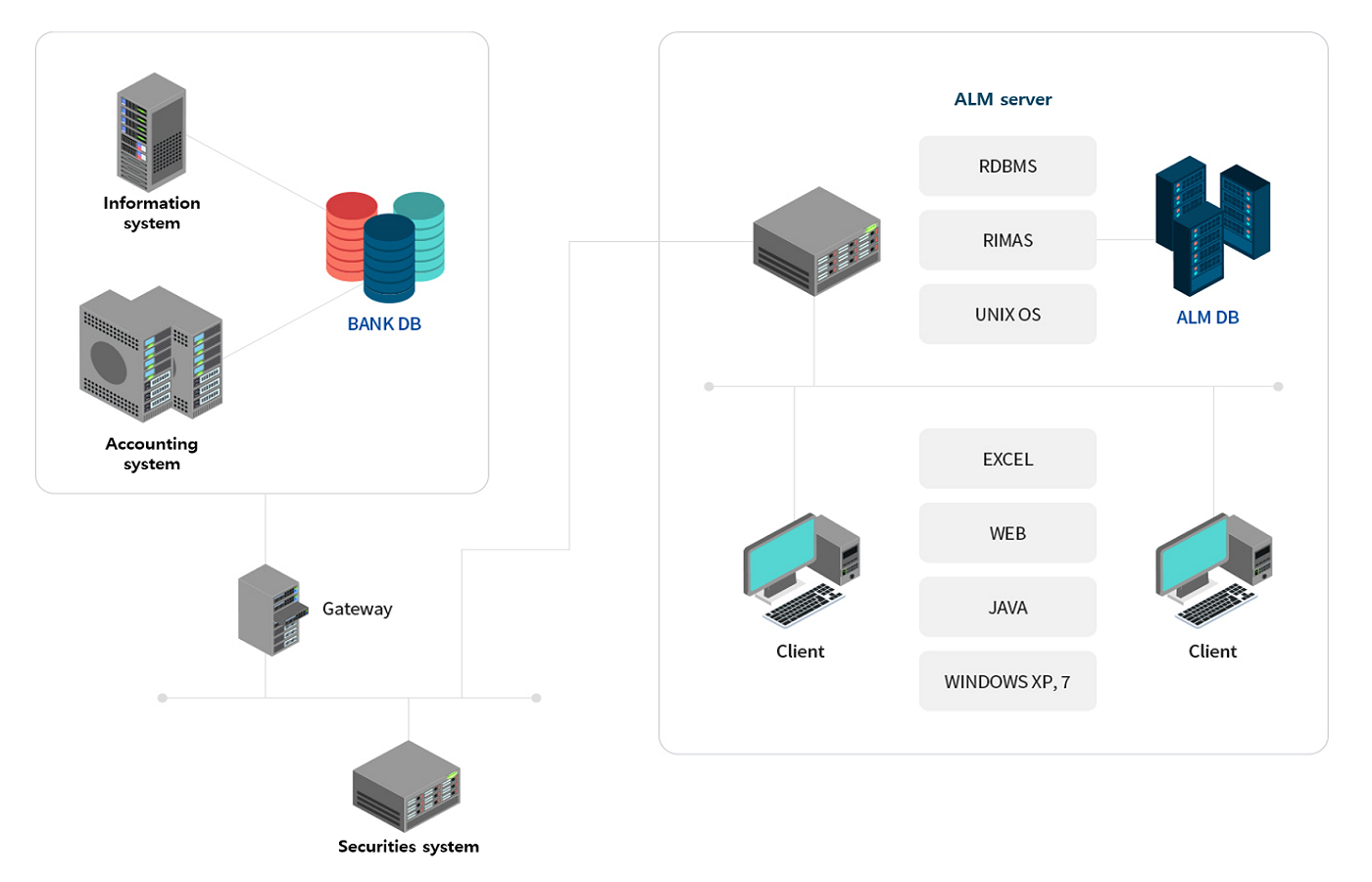

Asset-liability system

Aim at managing various risks(interest rate, market price, credit, etc.) that financial institutions face.

A general asset-liability management(ALM) system of financial institutions where the entire process from the extraction of source data, deployment of the target DB, status analysis,

simulation, to the output of the related reports to be downsized by combining the market and credit risks based on the ALM covering profit, expense, and profitability management.

A general asset-liability management(ALM) system of financial institutions where the entire process from the extraction of source data, deployment of the target DB, status analysis,

simulation, to the output of the related reports to be downsized by combining the market and credit risks based on the ALM covering profit, expense, and profitability management.

Diagram

Major functions

Conduct financial analysis on asset/debt.

Conduct risk analysis by using the risk analysis results of the interest rate and liquidity.

Conduct a simulation based on the defined scenarios.

Operate an early warning system by using risk analysis data.

Effects

Improve the capability of understanding the current status on risks and contribute to predicting the risks.

Effectiveness in profit & loss(PNL) increases by analyzing the various scenarios.

The ability of establishing a risk management system and business analysis is enhanced.

- Asset management system

- Securities trustee system

- Asset-liability system

- Performance analysis system

- Major references

- Contact

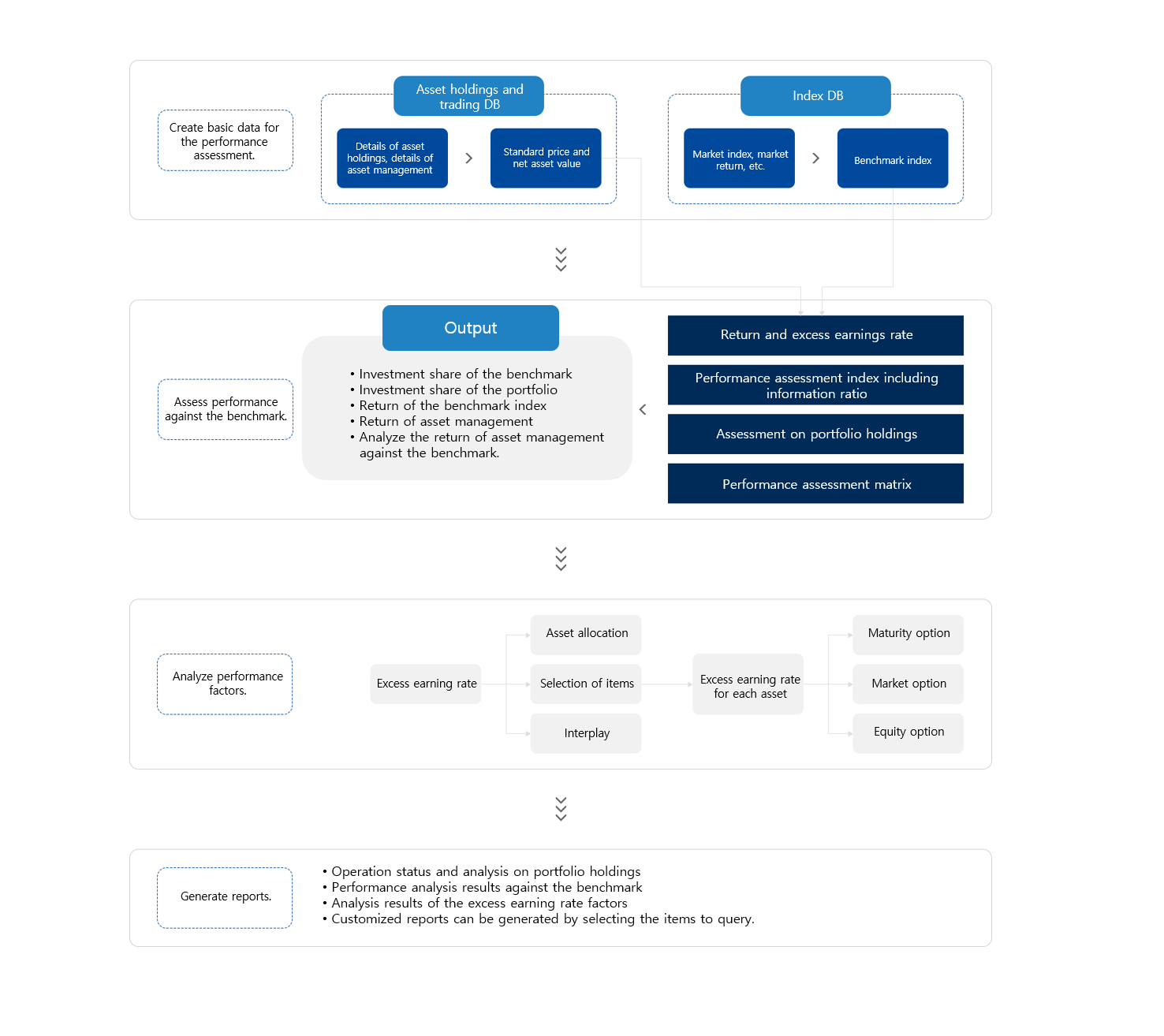

Performance analysis system

Creates basic data, assesses performance against the benchmark, analyzes performance factors, and generates reports.

Diagram

Major functions

Generate basic data including the details of the asset holdings, details of the asset management, benchmark index, etc.

Analyze the operating status including the return of the portfolio.

Analyze the performance factors including the asset allocation, selection of items, and multiple effects.

Effects

Support the proactive asset management towards the internal and external financial environment.

Business efficiency increases thanks to the system support useful to user.

Specialize in the operation and support; establish a performance/risk management system.

- Asset management system

- Securities trustee system

- Asset-liability system

- Performance analysis system

- Major references

- Contact

Major references of individual customers

| Business Year | Customer | Business Details |

|---|---|---|

| 2021 ~ 2023 |  Korea Post Information Center(KPIC) |

Re-deployed the asset management system. (Next-generation post office) |

| 2018 ~ 2019 |  DAISHIN Securities |

Developed and maintained a trust scheme for DAISHIN Securities. |

| 2017 |  National Credit Union Federation of Korea(NACUFOK) |

Made improvement in the securities management system. |

| 2016 |  Korea Post Information Center(KPIC) |

Advanced the system assessing the adequacy of the postal insurance liability. |

| 2016 |  DB Financial Investment |

Applied an ISA to a trust scheme and improved the scheme. |

| 2014 ~ 2015 |  DAISHIN Securities |

Deployed a trust scheme. |

| 2014 |  DB Financial Investment |

Developed and improved a trust scheme for DB Financial Investment. |

| 2013 |  National Agricultural Cooperative Federation(NACF) |

Expanded a middle office for securities. |

| 2013 |  DB Financial Investment |

Built a trust scheme S/W for overseas asset. |

| 2012 |  Samsung Fire & Marine Insurance |

Built a trust scheme. |

| 2011 |  Shinhan Investment |

Deployed a money market trust incorporated to overseas assets. |

| 2011 |  Korea Federation of Community Credit Cooperatives(KFCC) |

Built a dividends scheme. |

| 2011 ~ 2012 |  National Agricultural Cooperative Federation(NACF) |

Built a business restructuring system in the investment trust. |

| 2011 ~ 2012 |  Samsung Life Insurance |

Additionally developed asset management for a trust scheme. |

| 2011 |  Shinhan Investment |

Developed an overseas asset for a trust scheme. |

| 2010 ~ 2011 |  Leading |

Built a trust scheme for Leading Investment & Securities. |

| 2010 ~ 2011 |  National Agricultural Cooperative Federation(NACF) |

Deployed asset management IFRS in investment trust. |

| 2010 ~ 2011 |  KEB Hana Bank |

Built a real estate trust management system. |

| 2010 |  IBK Securities |

Deployed a trust scheme. |

| 2009 |  IM INVESTMENT & SECURITIES |

Built a trust scheme S/W. |

| 2009 |  Korea Post Information Center(KPIC) |

Developed an asset management system for Korea Post. |

| 2008 |  Shinhan Investment |

Built a real estate trust scheme. |

| 2007 |  Samsung Life Insurance |

Deployed a trust scheme. |

| 2006 ~ 2007 |  NH INVESTMENT & SECURITIES |

Built a trust pension scheme. |

| 2005 ~ 2006 |  Shinhan Investment |

Deployed a trust scheme. |

| 2005 |  DAISHIN Securities |

Built a trust scheme and retirement pension asset management system. |

| 2004 ~ 2005 |  MG Community Credit Cooperatives(CC) |

Developed an asset management system |

| 2004 ~ 2005 |  SEOUL GUARANTEE INSURANCE(SGI) |

Securties maangement system |

| 2004 ~ 2005 |  Korea Teachers’ Credit Union(KTCU) |

Financial asset management system |

| 2004 |  National Federation of Fisheries Cooperatives(NFFC) |

Re-deployed a securities management system. |

| 2003 |  Shinhan Bank(previously Chohung Bank) |

Securities investment trust system |

| 2003 ~ 2004 |  Korea Teachers’ Credit Union(KTCU) |

Conducted maintenance on the financial asset management system(eTravis 2.0) |

Applicable businesses of each area

| Institution | Applicable businesses | |

|---|---|---|

| Trust |

|

|

|

|

|

|

|

|

| Deposit & insurance of post office |

|

|

- Asset management system

- Securities trustee system

- Asset-liability system

- Performance analysis system

- Major references

- Contact

| Responsible Business | Contact |

|---|---|

| Financial solution / next-generation scheme |

|